Rental Yield vs Capital Growth: What Perth Property Investors Should Prioritize

Every property investor faces this fundamental question: should I prioritise rental yield (cash flow) or capital growth (equity)? The answer shapes suburb selection, property type, and ultimately, your wealth-building journey.

In Perth’s market, this choice is particularly relevant. The “rules” have shifted in 2025. We have seen a rare market phenomenon where traditionally high-yield stock—like villas and units—actually outperformed houses in capital growth for the first time in years. Choosing the right balance now isn’t just about cash flow; it’s about spotting where the next wave of demand will hit.

Understanding the Trade-Off

Rental Yield is the return your property generates through rent, expressed as a percentage of its value.

Capital Growth is the increase in your property’s value over time.

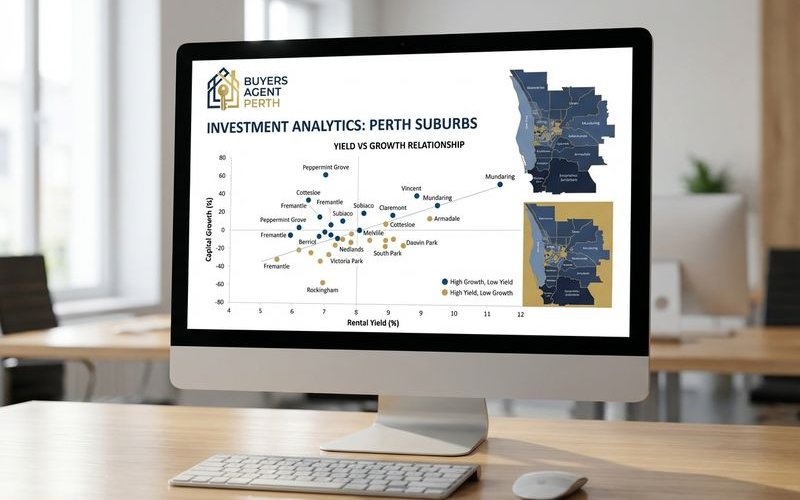

In most markets, including Perth, there’s traditionally an inverse relationship:

- High-yield properties often have slower growth.

- High-growth properties typically have lower yields.

This isn’t absolute, but it’s a reliable pattern. However, you must be aware of “Yield Compression.” As we saw in suburbs like Armadale throughout 2024, when a high-yield suburb suddenly booms in price (growing 20%+), the rental yield drops significantly for new entrants. What was once a 6% yielder might now be a 4% yielder because prices rose faster than rents.

The Math Behind Each Strategy

Let’s look at the real numbers for 2025/2026 to see how this plays out in your bank account.

High Yield Example (Cannington Villa/Unit)

This sector is currently outperforming due to affordability constraints pushing tenants and buyers away from houses.

- Purchase: $580,000

- Weekly rent: $660

- Annual rent: $34,320

- Gross yield: ~5.9%

- Expenses (3%): $17,400

- Net income: $16,920

The Outcome: You have stronger immediate cash flow to help service the loan, but your land component is smaller, which historically moderates long-term growth (though 2025 proved this isn’t always true).

High Growth Example (Scarborough House)

Coastal suburbs with high land value remain the champions of long-term equity, but the holding costs are significant.

- Purchase: $1,365,000

- Weekly rent: $995

- Annual rent: $51,740

- Gross yield: ~3.8%

- Expenses (2.5%): $34,125

- Net income: $17,615

The Outcome: The rental income barely covers a fraction of the mortgage interest at current rates. You are negatively geared, paying out of pocket monthly to hold the asset, betting on the $1.3M asset growing by 7-9% (roughly $100k) per year.

When to Prioritise Rental Yield

You Have Limited Borrowing Capacity Banks assess your ability to service a loan based on income. High-yield properties add more to your income column than they subtract from your servicing expenses, effectively boosting your borrowing power for the next property.

You Are “Rent-Vesting” If you rent where you live and invest elsewhere, you likely need the investment property to cover its own costs so you aren’t paying rent and a mortgage shortfall simultaneously.

You’re Starting Out First-time investors often cannot stomach a $1,000/month shortfall that comes with high-growth assets. Yield-focused properties are more forgiving and allow you to enter the market without changing your lifestyle.

You’re Risk-Averse Yield provides certainty. Rent comes in monthly and is contractually obligated. Capital growth is speculative and “on paper” until you sell or refinance.

Perth High-Yield Suburbs (2025/26 Focus)

| Suburb | Median Price | Yield | Character |

|---|---|---|---|

| Cannington | $749K (House) / $580K (Unit) | 5.9% | Major retail hub & transport |

| Bentley | $650K | 5.4% | Student catchment (Curtin Uni) |

| Balga | $540K | 5.3% | Affordable density infill |

| Maddington | $580K | 5.3% | Industrial & mixed-use corridor |

| Medina | $490K | 5.5% | Kwinana industrial hub |

When to Prioritise Capital Growth

You Have Secure, Surplus Income If your salary comfortably covers your living expenses and investment holding costs, you can afford to “feed” the property. You are essentially buying $1 worth of future assets for 90 cents today.

You’re in High Tax Brackets If you earn over $190k (47% tax rate including Medicare levy), negative gearing becomes a powerful wealth creation tool. The tax office effectively pays for nearly half of your ongoing losses, while you wait for the compounding capital growth (which is taxed at a 50% discount when held for 12+ months).

You Have Long Time Horizons Growth compounds over time. A 7% growth rate doubles your asset’s value in roughly 10 years. Five years might be flat—Perth saw this between 2014 and 2020—but fifteen years typically rewards patient capital growth investors.

You Want to Manufacture Equity Growth suburbs often allow for cosmetic renovations or subdivisions. Adding value to a $1.3M property in Scarborough yields a far higher return than renovating a $400k unit in Orelia.

Perth Capital Growth Suburbs (2025/26 Focus)

| Suburb | Median Price | Recent Growth | Character |

|---|---|---|---|

| Scarborough | $1.36M | 9.2% | Premium coastal revitalisation |

| Samson | $1.25M | 40.5% | Tightlys held family enclave |

| Brentwood | $1.15M | 37.1% | Applecross High School zone |

| Mandogalup | $850K | 33.0% | New corridor nearing capacity |

| Trigg | $2.38M | 8.5% | Exclusive coastal blue-chip |

The Balanced Approach: The “Villa” Sweet Spot

In 2025, we are seeing a massive shift toward the “middle ground.” With house prices in premium suburbs becoming out of reach for many, demand has spilled over into villas and townhouses in those same blue-chip areas.

This approach offers a unique hybrid:

- Better Yield: Villas often yield 5%+, compared to 3% for houses in the same suburb.

- Land Content: Unlike apartments, you own a portion of the land (strata), which drives growth.

- Growth Catch-Up: In 2025, Perth units grew by roughly 20%, outpacing houses (13.3%) as the price gap closed.

Perth Balanced Suburbs

| Suburb | Price | Yield | Growth | Why It Balances |

|---|---|---|---|---|

| Thornlie | $650K | 4.6% | 20%+ | New Metronet station link |

| Morley | $720K | 4.6% | 15%+ | Morley-Ellenbrook Line opening |

| Gosnells | $550K | 5.0% | 18% | Revitalisation & affordability |

| Wandi | $780K | 4.2% | 22% | Family demand + freeway access |

Portfolio Strategy: Not Either/Or

Sophisticated investors don’t choose between yield and growth—they balance their portfolio to keep borrowing.

The “Borrowing Capacity” Trap If you buy three high-growth, low-yield properties (e.g., negative gearing $15k/year each), you will likely hit a “servicing wall” with the banks. They won’t lend you more money because your cash flow is too poor.

Typical Portfolio Evolution

Phase 1: Foundation (Properties 1-2)

- Focus: Balanced or High Yield.

- Goal: distinct from “quick wins,” the goal here is to secure assets that don’t hurt your lifestyle. A $600k villa in Cannington provides a solid base without eating your monthly wage.

Phase 2: Acceleration (Properties 3-4)

- Focus: Capital Growth.

- Goal: Use the equity from Phase 1 and your remaining serviceability to buy a “heavy lifter”—a property with high land value in a scarce suburb like Scarborough or Victoria Park.

Phase 3: Consolidation (Properties 5+)

- Focus: High Yield / Commercial.

- Goal: Improve overall portfolio cash flow to prepare for retirement or debt reduction.

Impact of Leverage

Leverage (using borrowed money) amplifies both strategies, but it also amplifies the risks.

High Yield + Leverage

- Positive cash flow increases with scale.

- Insider Tip: Watch out for the WA Land Tax Threshold. It kicks in once the unimproved value of your landholdings exceeds $300,000. If you buy three cheap houses in Armadale, you might inadvertently cross this threshold, and the tax bill will eat your positive cash flow.

High Growth + Leverage

- Equity grows faster. A 10% gain on a $1M property ($100k) is far more impactful than a 10% gain on a $400k property ($40k).

- Risk: Interest rate sensitivity. A 1% rise in rates on a $1M loan adds $10,000 to your annual costs. You need a significant financial buffer.

Example: $1M Investment Capacity

Option A: Two balanced properties ($500k each)

- Diversified across two locations.

- Risk of vacancy is spread (unlikely both are empty at once).

- Land tax might stay under the radar if land values are low.

Option B: One high-growth property ($1M)

- Single tenant risk (100% vacancy if they leave).

- Higher quality asset, likely better long-term capital appreciation.

- Lower maintenance hassle (one roof vs two).

Market Cycle Considerations

Yield and growth preferences should adapt to where Perth sits in the property clock.

Early Cycle (Recovery)

- Yields are often high because prices are still low.

- Strategy: Buy Growth. This is when you pick up the “bargains” in blue-chip areas before the masses return.

Mid Cycle (Expansion - Perth 2024-2025)

- Prices rise rapidly, compressing yields.

- Strategy: Pivot to “Laggards.” When houses become too expensive, the demand shifts to units and villas. This is exactly why we saw Perth units jump 20% in 2025.

Late Cycle (Peak)

- Yields are at their lowest; affordability is stretched.

- Strategy: Focus on Yield and debt reduction. Don’t speculate on further massive growth.

Tax Implications

Understanding the tax layer is crucial for your net result.

Rental Income vs. Capital Gains Rental income is taxed at your marginal rate today. Capital gains are taxed only when you sell, and you get a 50% discount if you’ve held for over a year. This makes capital growth more tax-efficient for high-income earners.

Depreciation (Division 43 vs 40) Don’t ignore depreciation. A newer high-yield property (or a newly built one) offers significant non-cash deductions.

- Division 43: Capital works (the building itself).

- Division 40: Plant and equipment (blinds, ovens, carpets).

- Tip: You can often turn a slightly negative cash flow property into a “cash flow positive after tax” investment just by claiming these correctly.

Negative Gearing For a clear example: If you are in the 45% tax bracket and lose $10,000 in cash flow on a property, the ATO effectively refunds you $4,500. Your “real” cost to hold that high-growth asset is only $5,500.

Your Investor Profile

Consider which profile matches your situation:

The Security Seeker

- Priorities: Stable income, low stress, sleep-at-night factor.

- Best strategy: High Yield (Commercial or Residential).

- Ideal suburbs: Established, affordable areas like Balga or Medina.

The Wealth Builder

- Priorities: Maximum net worth capability, delayed gratification.

- Best strategy: High Capital Growth.

- Ideal suburbs: Coastal or Near-City (Scarborough, South Perth, Leederville).

The Balanced Investor

- Priorities: Hedging bets, sustainable portfolio growth.

- Best strategy: “Sleeper” suburbs or Villas in blue-chip areas.

- Ideal suburbs: Middle-ring with infrastructure upgrades (Morley, Thornlie).

Making Your Decision

Questions to guide your strategy:

-

What is your borrowing capacity right now?

- Maxed out? → You need Yield to service the next loan.

- Plenty of room? → You can afford to target Growth.

-

What is your legitimate risk tolerance?

- Can you cover a $4,000 hot water system replacement without panic? If not, you need the cash flow buffer of a yield property.

-

What is your timeline?

- Under 5 years? → Don’t rely on growth; it’s too volatile. Stick to Yield.

- 15+ years? → Growth will almost always outperform yield.

-

Have you checked the Land Tax threshold?

- If you already own property, check if your next purchase pushes your aggregated land value over $300k (or the next bracket at $420k). The tax bill might shock you.

The Perth Advantage

Perth’s investment landscape offers genuine choice in 2026. Unlike Sydney, where yields are universally compressed (often under 3%), Perth still offers pockets of 5%+ yield if you know where to look.

We are also seeing a structural shortage of housing supply that isn’t resolving quickly. With new builds taking 24+ months and costing 30% more than established homes, the floor under Perth property prices remains incredibly strong.

Need help choosing your investment strategy? Our buyers agents analyse both yield and growth factors for every property we assess. We match properties to your investor profile.

Book a strategy consultation to discuss your investment direction.

Topics

Related Service

Data-driven investment property acquisition for serious investors. Expert suburb analysis, yield optimization, and off-market access to high-performing assets.

Learn About InvestmentBuyers Agent Perth

Investment Property Specialists

Expert property advice from the Buyers Agent Perth team. We help Perth buyers find and secure their ideal properties.